The Credit Intelligence Suite

Empowering credit analysts and risk officers with precision diagnostic tools to assess liquidity, detect fraud, and simulate operational shifts.

Financial Analysis

Interactive Balance Sheet Explorer

A robust tool to input, visualize, and analyze balance sheet figures in both T-Format and Vertical Report Format. Detects fund diversion and liquidity gaps.

Trend Detection Engine

Compares multi-year financial statements to automatically detect performance trends, margin pressure, and asset utilization shifts.

Operating Statement Recaster

A forensic tool to isolate core operational profit from non-operating windfalls. Detects if a business is truly self-sustaining or surviving on incidental income.

Ratio "What-If" Stress Simulator

Experiment with accounting choices and stress-test your financials. See how inventory devaluation or debt reclassification affects bankability.

Industry Benchmark Profiler

Compare borrower input composition (RM/Costs/Profit) against industry standards like Gold Manufacture or Heavy Engineering. Detects "Rosy Projections".

Cash Conversion Cycle (CCC) Simulator

Analyze the "Merchandising Cycle" efficiency. Visualize how DIO, DSO, and DPO interact to create your working capital gap.

Risk & Forensic

Forensic Red Flag Scorecard

A diagnostic engine to detect "Window Dressing" and manipulation. Identifies capital cycling and circular trading patterns used to inflate limits.

Bank Statement Analyzer

Forensic review of bank operations to detect non-operational transactions, cash withdrawals, and circular funding. Critical for limit monitoring.

Asset Quality Analyzer

Calculate your "Real" liquidity by applying haircuts to audited assets like rejected inventory or disputed receivables.

Associate Business Logic Mapper

Visualize group structures and detect circular funding cycles. Identifies if capital is being reused across entities to artificially boost group net worth.

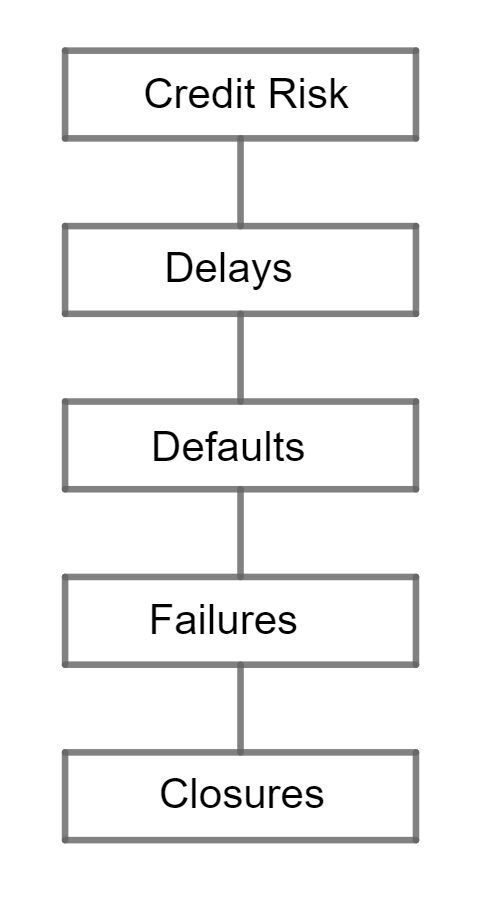

Credit Risk Scoring Engine

A customizable scoring model to assign risk grades based on weighted financial and non-financial parameters (RBI/CIBIL Guidelines).

Borrower 360: Character & Capability Evaluator

A comprehensive qualitative and quantitative scorecard. Evaluates character, motivation, and leadership alongside working capital requirements and industry-specific production cycles.

Structural Position Simulator

Stress-test a Balance Sheet against 23+ different transformations like asset shifting, debt repayment, and capital changes.

Projections & Planning

CMA Data Generator

Streamlined utility to prepare Credit Monitoring Arrangement data for working capital and term loan appraisals.

NWC Transaction Simulator

A powerful visualization tool to simulate business decisions and see real-time impact on Working Capital and Net Worth.

Loan Sanction Predictor

High-speed assessment of loan eligibility using stability factors, CIBIL scores, and key repayment margins.

Working Capital Assessment Engine

Compare "Turnover Method (Nayak)" vs "MPBF Method II" vs "Cash Budget". Determine the optimal credit limit based on 2026 banking directives.

Project Finance & Sensitivity Simulator

Simulate how project viability (DSCR & BEP) reacts to shifts in raw material costs, sales realization, or interest rate hikes.

Credit Operations

Drawing Power & Margin Optimizer

Simulate how varying margins on RM, WIP, and FG affect actual liquidity. Perfect for optimizing sanctioned limit utilization.

Advanced Analytics

BEP Interactive Engine

Simulate break-even points for units, sales turnover, and capacity percentage with real-time graph updates. Visualize your safety buffer.

CVP Sensitivity Analyzer

Analyze how fluctuations in raw material costs or selling price impact your project's profitability threshold and margin of safety.

Feasibility Comparator

Compare multiple credit proposals side-by-side based on their BEP profiles, P/V ratios, and Margin of Safety metrics.