Home

Risk Based Supervision

Risk based Supervision

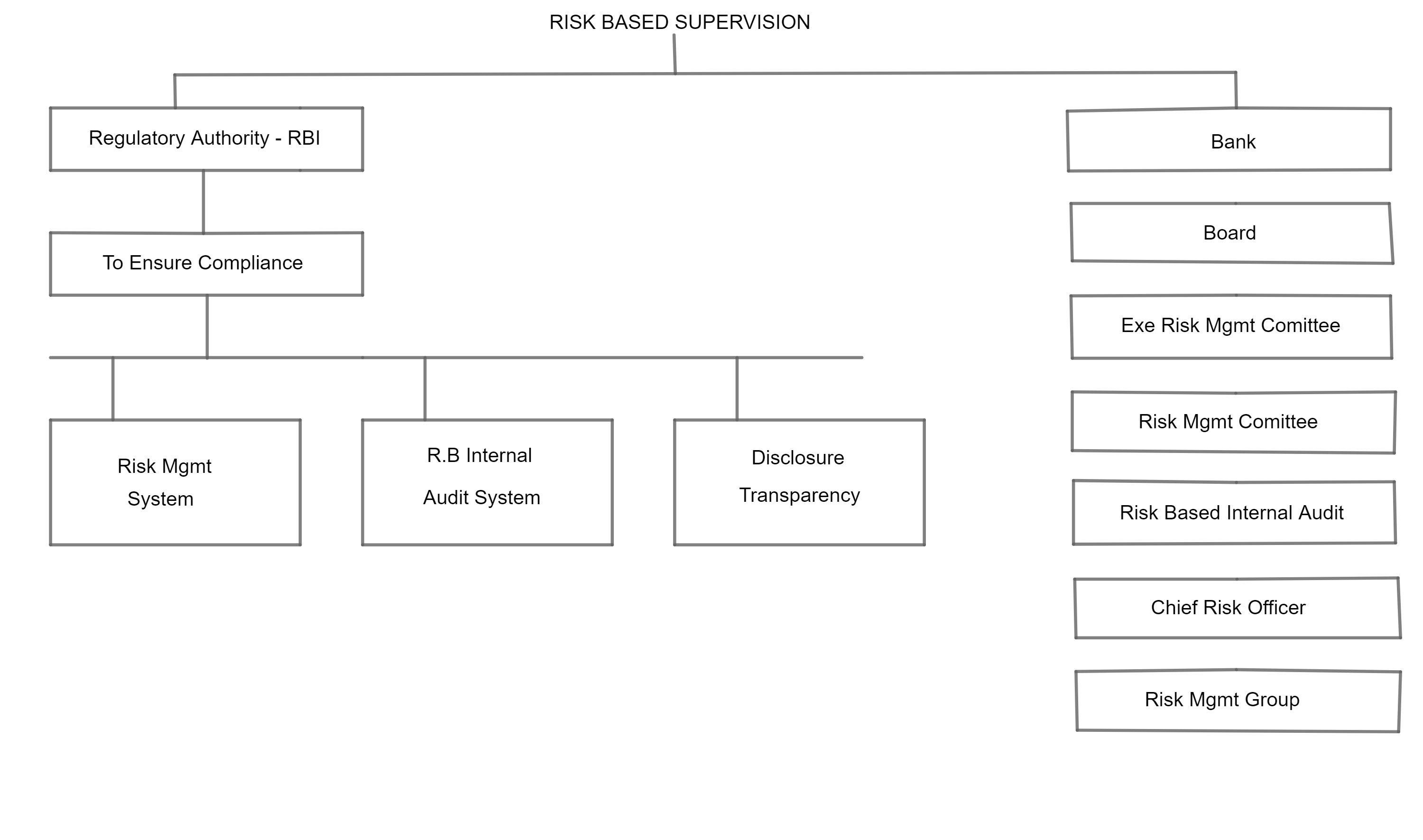

Risk based supervision is all about continuous monitoring and assessing How well a banks internal control systems operate in actual and projected environment. Such a supervision makes up for a forward looking. Proactive supervisory programme unlike the old system where we examine by hind sight the concluded transactions. After the industry experienced huge failures, there is now focused attention to the internal control systems.

The key to the risk based supervision is finding a way to ensure that the banks have in place adequate systems of internal control.

The systems in place should be able identify, monitor and manage risk rather than be devoted to the review of discrete transactions. Such a system should be tested on an ongoing basis to ensure that the internal control system fuction the way they should.

Basle committee noted and attributed the problems leading to significant losses in the industry to

1. Inadequate assessment of the risk of certain banking activities whether on or balance sheet. Major losses were found to occur due to the failure of the bank to continuously assess the products and activities or update risk assessment when significant changes occurred in the environment or business conditions. The existing control systems were found to be wanting to cope with such a change

2. Lack of management over sight and accountability and failure to develop strong control culture with in the bank.

3. The absence of Key control activities like segregation of duties, approvals, verifications, reconciliations and review of operative performance.

4. Inadequate communication of information between the levels of management with in the bank

Following principles have been laid down for the assessment of internal control systems, management oversight and control culture.

1. The board of directors should have the responsibility for approving strategies and policies; understanding the risks run by the bank setting acceptable levels for these risks; ensuring that the senior management takes steps necessary to identify control and monitor these risks approving the organizational structure; and ensuring that the senior management is monitoring the effectiveness of the control system

2. Senior management should have the responsibility for implementing strategies approved by the board

3. Board and senior management are responsible for promoting high standards of ethics and integrity and for establishing a culture with in the organization that emphasises and demonstrates at all levels the importance of internal control system

4. Senior management should ensure that the risks and internal and external factors affecting the achievement of the banks strategies and objectives are continually being evaluated

5. Control activities should be an integral part of the daily operations of a bank S.M. to ensure this

6. S.M. to ensure that there is appropriate segregation of duties

7. S.M. to ensure that there are adequate and comprehensive internal financial, operational and compliance data.

8. S.M. to ensure and establish effective channels of communication to ensure that all levels staff are fully aware of policies and procedures affecting their duties and responsibilities. S.M. to also ensure that there exists appropriate information systems.

9. S.M. should continually monitor overall effectiveness of the banks internal controls.

10. There should be an effective and comprehensive internal audit and control system carried out by trained staff.

11. There should be system for timely reporting of deficiencies.