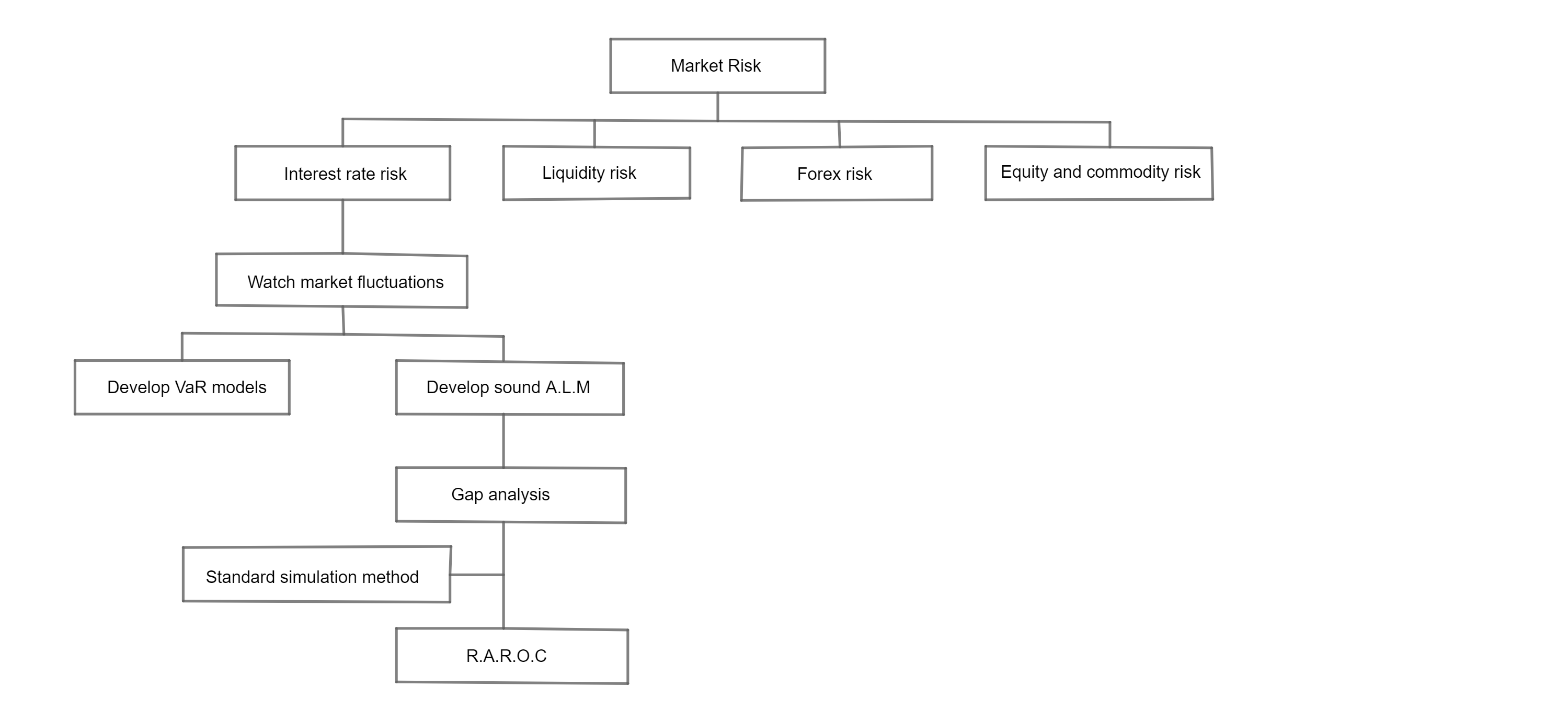

Market Risk in Banking

Managing potential losses from adverse movements in market prices, including interest rates, equities, and forex.

The Dynamics of Pricing Risk

Market risk arises from adverse movements in the level or volatility of market prices of interest rate instruments, equities, commodities, and currencies.

The typical measure associated with the probability of loss or gain in a position over a specified time horizon.

Basel Supervisory Treatment

In 1996, the Basel Committee extended the 1988 accord to cover market risk capital charges.

Measurement Approaches:

- Standard Approach: Regulatory-defined risk weights.

- Internal Model: Proprietary models (VaR-based).

Capital Tiers:

Tier 3 Capital Constraints:

- Minimum maturity must be not less than 2 years.

- Limited to 250% of Tier 1 capital.

- Eligible *only* to cover market risk (Forex, Commodity).

- Lock-in Clause: Principal/Interest cannot be paid if capital falls below minimum requirements.

The Five Pillars of Market Risk

Liquidity Risk

Inability to meet obligations or fund asset increases without unacceptable losses.

Interest Rate Risk

Impact of rate volatility on Net Interest Income (NII) and Capital.

Forex Risk

Adverse currency movements affecting foreign exchange positions.

Commodity Risk

Volatility in prices of traded commodities.

Equity Risk

Movement in stock prices affecting bank-held investment portfolios.

Exposure Aggregation

Banks must capture all material sources of market risk and aggregate total exposure assumed at any point. This requires effective Asset-Liability Management (ALM) and sound accounting systems.