Home

Credit Risk

What is Credit Risk?

This is the most familiar form of risk since banking meant business of lending. This is most dominant part of the various risks that banks are confronted with Several techniques and tools are in vogue and are also being evolved. As the lending activity continue to dominate as a main stay for profit making addressing ssour major concern to this risk is not out of focus.

Credit risk is most simply defined as the potential that a bank's borrower or counter party will fail to meet its obligation in accordance with the agreed terms

The goal of risk management is therefore to maximize the banks Risk adjusted rate of return by maintaining credit exposure with in acceptable parameters.

The effective management of credit risk is a critical component of a comprehensive approach to risk management. This is essential to the success of any banking organization.

Banks are expected to identify the credit risks and measure, monitor, control so as to ensure that they hold adequate capital against these risks and share holders are adequately compensated.

Basle Guideline Areas on Credit Risk Management

Basle committee has issued a comprehensive document (Integrated guide lines on credit risk management, disclosures and Accounting, July, 1999) in order to encourage and promote sound practices for managing credit risk. The sound practices set out in this document specifically address the following areas.

1. Establish appropriate credit risk environment

2. Operate under sound credit granting process

3. Maintain appropriate administration and monitoring process

4. Ensure adequate control over credit risk.

Banking supervisors are expected to carry out meaningful assessment of the banks in all countries by seeking disclosures in the following areas:

Accounting policies

Credit risk management

Credit exposures

Credit quality

risk specific dictated by the size, complexity of functions levels of technical expertise and quality of M.I S.

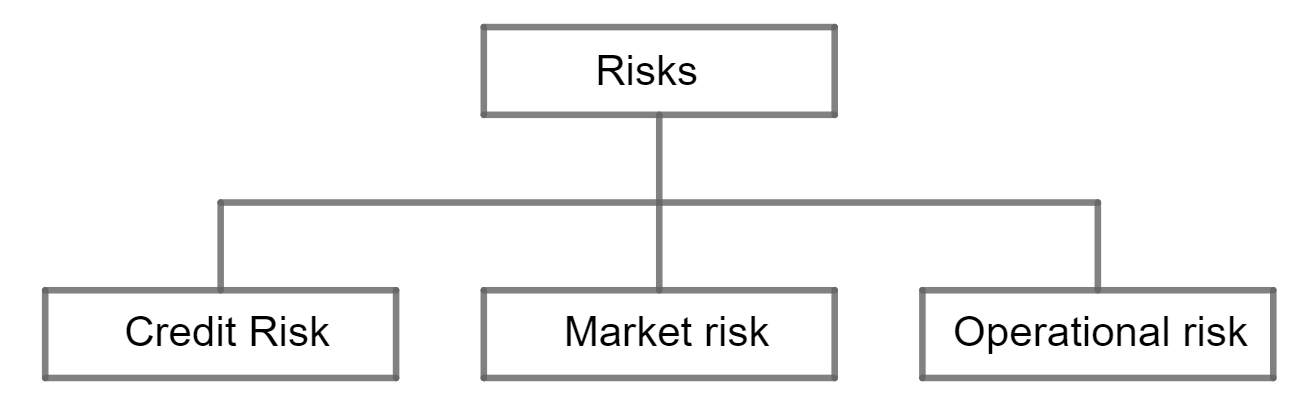

Categories of Risk

As a primary step towards risk management efforts we have to understand appreciate various category of risks.

Risks are broadly classified as:

1. Credit risk

2. Market risk

3. Operational risk

4. Others

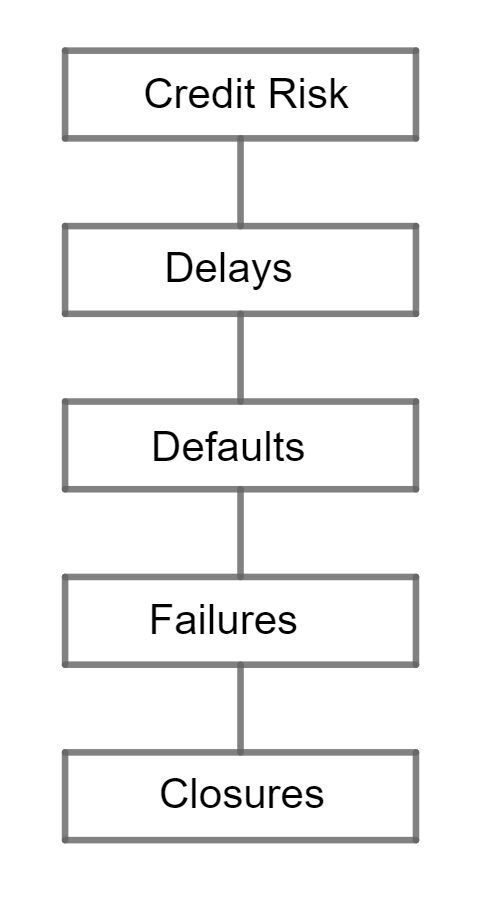

Credit Risk Components